13 May 2024

Lucara Diamond Corp.’s revenue fell in the first quarter as the quantity of large stones sold into the miner’s offtake agreement with HB Antwerp dropped.

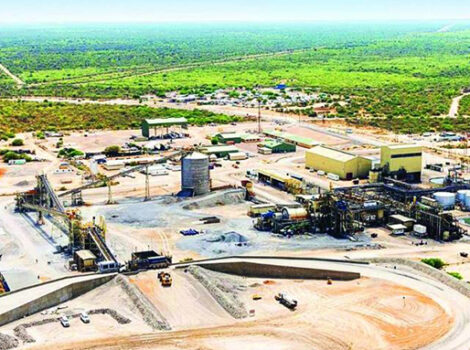

Sales declined 4% year on year to $41.1 million, the company reported last week. It sold $36.2 million worth of goods through tenders and its Clara online platform and received $4.9 million in top-up payments as part of an arrangement with HB Antwerp, which purchases all diamonds weighing more than 10.8 carats from the Karowe mine in Botswana. That compares with $6.6 million in top-up payments during the same period a year ago.

During the first three months of the year, prices of smaller goods stabilised, with increases of 4% compared to the previous quarter, while larger goods saw quarter-on-quarter growth of 18%. Despite the improvement in pricing, a decrease in the quantity of larger rough available for sale impacted revenue.

The company reported a net loss of $7.9 million compared to a net profit of $1 million last year. The loss was primarily the result of paying off a $10.5 million debt incurred in the first quarter, Lucara explained.

In the first quarter, the miner recovered 89,145 carats, a 0.6% decrease from the equivalent period a year ago.

The company maintained its revenue projection of $220 million to $250 million for 2024, noting that diamond recoveries and quality improved during April. However, it warned that recent variability in the output and quality in the last two quarters could affect revenue guidance for the full year if it continued.

“Work on the underground expansion project at Karowe…progressed well during the quarter,” said Lucara CEO, William Lamb.

“[This] positions us to access the higher-value ore from the underground portion of the ore body early in 2028. While the diamond market remained relatively stable in the first quarter, we observed some cautious sentiment due to the broader macroeconomic climate of high inflation and interest rates impacting consumer demand in certain regions.

However, the fundamental supply-and-demand dynamic continues to favour natural diamonds over the long terms as new mine supply remains constrained.”

Source: https://rapaport.com/news/large-stone-slowdown-dents-lucara-diamond-corp-revenue/