Lucara Diamond is reworking its $514 million (P6.2 billion) plans for an underground mine, moving key works to next year and revising how the funding will be finalised, as the coronavirus (COVID-19) plays havoc with previous estimates.

Lucara, the 100% owner of Karowe Mine, had planned to spend $53 million on various activities around the underground project this year, mostly around long-lead time procurement, with some physical works due before year end. The underground mine, due to be developed over five years to 2026, represents Karowe’s future.

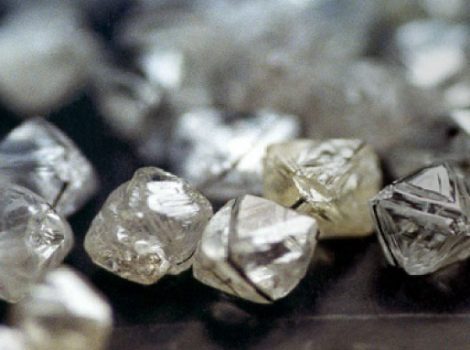

The Karowe mine, situated near Letlhakane in the Boteti sub-district, has become world famous for large diamond discoveries such as Lesedi la Rona, the Constellation and Sewelo.

Lucara Botswana managing director, Naseem Lahri said the pandemic had forced the postponement of the diamond company’s second tender scheduled for mid-May. The first tender, held in March, saw 104 companies attending in Gaborone and 83,610 carats sold.

Lahri explained that the planned proceeds from the second tender, as well as other estimates of revenues and costs this year, were all contributing to the need to rework the budget and timelines around the underground project.

“Given the uncertainty in global markets resulting from COVID-19, the originally planned capital budget will be reduced until more certainty exists around our cash flow projections,” she said in a written response to BusinessWeek questions.

“The results from the second tender of the year will be an important point for us and will guide our thinking around how we invest our capital.

“We had some activities relating to the pre-sink on the ventilation shaft taking place in 2020, which will probably be pushed out into 2021, however, our focus is to get in the manufacturing queue for some of the specialised shaft-sinking equipment and proceed with the detailed design and engineering.

“The physical civil work can start in 2021.”

The original estimated cost of the underground project, $514 million, is being reviewed in line with the ‘quantum and timing’ of cash flows expected from the current operations against the anticipated financing requirement for the underground expansion programme, the MD said.

“The company is continuing to explore debt financing options for the underground expansion for those amounts, which are expected to exceed the company’s cash flow from operations during the construction period,” Lahri said.

Lahri added despite the gloom, Lucara was seeing rays of hope in the diamond market, which it hoped to tap into using its Clara digital sales platform. Six sales were held through the Clara digital platform in the first quarter, with $3 million (P36m) in total volume transacted.

“We are now beginning to see pockets of demand emerging, mostly in Asia, and we are hopeful that this will continue,” the MD said.

“Also, Antwerp is beginning to come out of lockdown, which is another positive sign.

“The Government of Botswana has granted Lucara the option of selling diamonds outside of Botswana to facilitate easier access for our customers.

“As a result, we have taken a good portion of our goods to Antwerp in anticipation of that market being one of the first to open.”

COVID-19 related travel bans and restrictions of movement across the world have depressed the market for diamonds this year, forcing producers to cut back their production and in some instances, send workers home.

Source: http://www.mmegi.bw/index.php?aid=85598&dir=2020/may/22