Russia’s Alrosa is the only major diamond company currently producing in Angola via its stake in the Catoca mine (pictured) – one of the world’s largest. Diamonds reserves in Russia, Congo and Botswana combined account for at least 80.6% of the world’s total, estimated at 1.1 billion million carats, a report released on Wednesday shows.

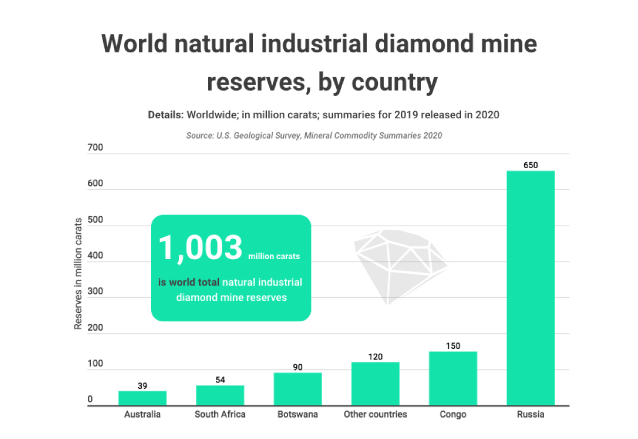

According to data gathered by London-based Learnbonds.com, Russia has the largest reserves at 650 million diamond carats, representing about 52% of the global capacity. Congo comes in second with 150 million carats or 13% of the world’s total, the report shows, while Botswana takes the third place, with diamond reserves totalling 90 million carats.

South Africa and Australia also account for a significant portion of the global reserves, with 54 and 39 million diamond carats respectively. Despite the current drop in demand, a result of lockdown measures triggered by the coronavirus pandemic, Learnbonds.com expects sales of rough stones to climb steadily over the next 30 years.

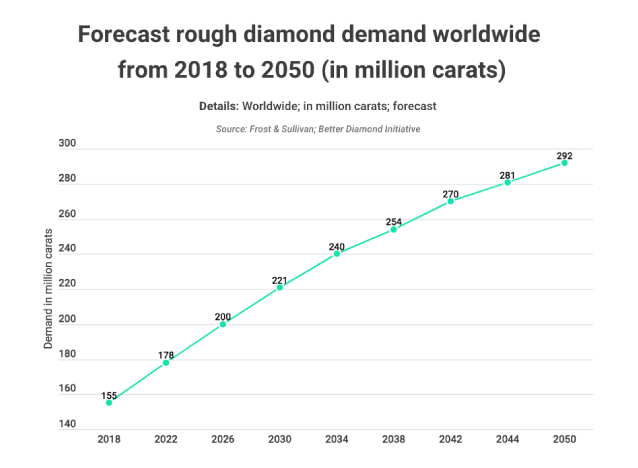

The study predicts that demand will hit 292 million carats by 2050, representing a growth of more than 88% by from 2018’s figure of 155 million diamond carats.

Sector in crisis

The forecast seems nearly too optimistic when considering current market conditions. The global diamond sector was still reeling from a collapse in prices and sales since late 2018, when covid-19 hit earlier this year. A couple of months into serious measures to slow the spread of the virus, it has already squashed diamond miners’ dawning hopes of a recovery.

Alrosa (MCX: ALRS), the world’s top diamond producer by output, reported on Tuesday a 95% decline in sales during April, compared to the same months last year.

Last week, the Russian state-controlled company had decided to halt production at two of its mines, citing worsening market conditions.

De Beers, the world’s largest producer by value, cut 2020 production guidance by a fifth last month. It had earlier cancelled its April sales event.

Canada’s Dominion Diamond Mines, the controlling owner of Ekati mine and a 40% partner to Rio Tinto in the Diavik mine, filed for insolvency protection in April.

Lucara Diamond (TSX:LUC), another Canadian company, posted last week a net loss of $3.2 million, or $0.01 a share, for the first three months of the year.

The figure was in sharp contrast with the $7.4 million in net income, or $0.02 in earning per share the miner reported in the same period last year. South Africa’s Petra Diamonds (LON:PDL) has recently delayed interest payments to borrow $21 million in new debt, a crucial move to keep the company afloat. Investment banks are increasingly reluctant to extend credit to diamond producers, as inventory is not being sold and defaults are possible, analysts have warned.

“We are concerned about the oversupply of rough diamonds following the reopening of economies, as a lot of inventory could potentially be flooded into the system and the market might not be able to absorb all of it, resulting in increased pricing pressure,” Citi said in an early May note.

The global diamond market was still reeling from a collapse in prices and sales since late 2018 when COVID-19 hit earlier this year

Source: http://www.mining.com/these-three-countries-hold-80-of-global-diamond-reserves/

Hey there! This is my first review here, so I only wanted to give a shout out and I genuinely enjoy looking at your articles. Is not possible to find other blogs/websites/forums of which handle Botswana subjects. Thanks.