10 June 2024

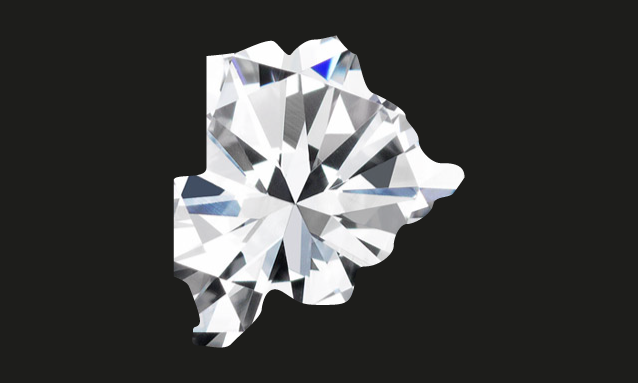

Botswana said it’s in talks over increasing its shareholding in De Beers, as Anglo American prepares to end its almost century-long relationship with the iconic diamond producer.

As part of a turnaround plan to fend off an approach from BHP Group, Anglo last month said it planned to sell or separate De Beers, in which it holds an 85% stake. The remainder is owned by Botswana, the southern African nation that holds the company’s biggest diamond mines.

“We are going to increase the shares that we have in De Beers,” Botswana President Mokgweetsi Masisi told a political rally in Palapye, about 300 km north of the capital Gaborone.

The government would also play a central role in selecting a new investor to replace Anglo at De Beers, according to the president. It would require an investor prepared for the cyclical nature of the diamond business, he said.

That volatility created frustration within Anglo, where De Beers’s erratic performance eroded returns from more coveted commodities, such as copper. Last year, the business made just $72-million, though traditionally its profits have ranged between $500-million and $1.5-billion as the diamond industry swings from boom to bust.

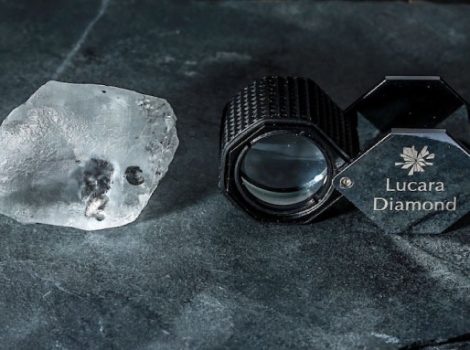

De Beers CEO Al Cook is targeting annual core profit of $1.5-billion by 2028, as he overhauls the business. That reset includes renewing the company’s focus on promoting natural stones — and ditching a venture into lab-grown gems — while expanding its retail footprint through its own jewelry stores.

The company will also dip its toe into polishing its own stones, part of the industry dominated by mostly family run firms in India and Belgium.