8 January 2024

London-listed critical metals exploration and development company Aterian has signed a share purchase agreement (SPA) to acquire a controlling 90% interest in private Botswana-registered business Atlantis Metals, which holds several mineral prospecting licences in the country.

Atlantis currently holds four licences covering a combined area of 3 516 km2, with one 999 km2 licence targeting copper in the Kalahari Copperbelt and three licences targeting lithium brine exploration within the Makgadikgadi region of northern Botswana.

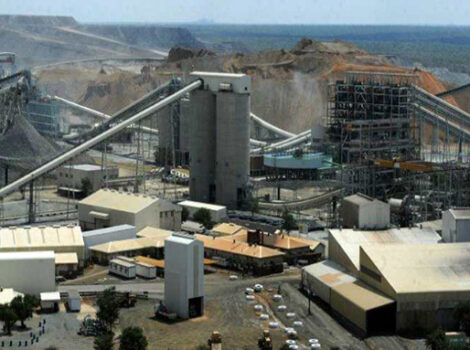

The copper-focused licence is located 50 km east of Khoemacau Copper Mining‘s Zone 5 mne, which contains 92.9-million tonnes grading 2% copper and 21 g/t silver.

The other three lithium brine-focused licences cover a combined 2 517 km2 over an area east of Sua Pan in the Makgadikgadi Pans.

The vendor, who will retain a 10% shareholding in Atlantis, is a private Botswana citizen and a professional geologist who will manage Atlantis and the company’s exploration activities in Botswana for at least 12 months.

Aterian has noted that the licences are located close to good infrastructure, including national highways and power.

“The signing of this SPA, to acquire substantial mineral licence assets in Botswana, further expands our presence on the continent. It perfectly fits our strategy of focusing on the critical metals, copper and lithium, in stable jurisdictions.

These new lithium brine licences in Botswana underscore our advancing lithium exploration efforts in Rwanda, where we recently announced an earn-in joint venture with [mining major] Rio Tinto. We have been busy and look forward to updating the market on our continued exploration efforts,” Aterian chairperson Charles Bray said on January 8.

Aterian also owns copper assets in Morocco that he said were showing increasingly promising results.

Under the SPA, Aterian will assume responsibility for funding exploration activities. Exploration expenditure commitments, the acquisition consideration and professional service fees will total a minimum of $80 000 and be payable over 12 months.

Given the early-stage nature of the new licences, initial workstreams will concentrate on data collection and acquisition from the Ministry of Mines and Energy to allow for a desktop review and target generation exercise, Aterian explained.

This will be supported by preliminary reconnaissance of the licences with first phase soil sampling if deemed appropriate and water sample collection from pre-existing wells within the area of Sua Pan.

Source: https://www.miningweekly.com/article/aterian-acquires-90-controlling-interest-in-atlantis-2024-01-08