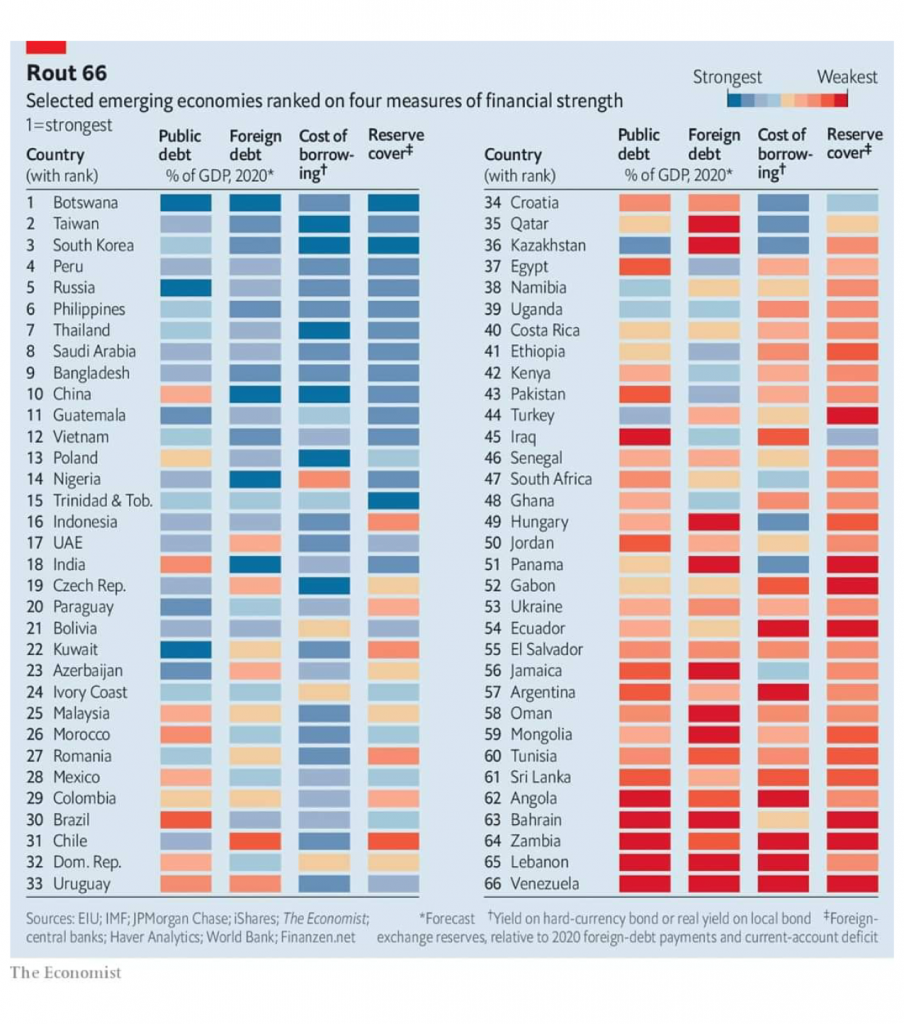

The Economist has ranked Botswana the world’s number 1 Emerging Market out of the 66 assessed. Botswana attained this based on four measures; financial strength, Low Public Debt, Low Foreign Debt, great Cost of Borrowing and sufficient Foreign Reserves. The relative calm also allows for a more discerning look at emerging-market strains. Some have wide fiscal or external deficits; others have high debts. In some, the weak link is the government; elsewhere it is the private sector. Debt may be largely domestic, or it may be owed to foreigners—and sometimes in foreign currency, too.

The Economist ranking examines 66 economies across four potential sources of peril. These include public debt, foreign debt (both public and private) and borrowing costs (proxied where possible by the yield on a government’s dollar bonds).

It also calculated the countries’ likely foreign payments this year (their current-account deficit plus their foreign-debt payments) and compare this with their stock of foreign-exchange reserves. A country’s rank on each of these indicators is then averaged to determine its overall standing.

The strongest countries, such as South Korea and Taiwan, are overqualified for the role of emerging markets. Many bigger economies, including Russia and China, also appear robust. Most of the countries that score badly across our indicators tend to be small. The bottom 30 account for only 11% of the group’s GDP and less than a quarter of both its foreign and its public debt.

The ranking also reveals the vast differences in the source and scale of potential weaknesses. Countries like Angola, Bahrain and Iraq have public debt that some reckon will exceed 100% of GDP this year. But about half of the economies examined have debts below 60% of GDP, the threshold that euro-zone members are supposed to meet (and which few do).

Bond yields, meanwhile, show how costly foreign borrowing will be. Sixteen of the economies must offer yields of over 10% on their existing dollar bonds to find takers. But over 20 have hard-currency bonds yielding less than 4%, the kind of cheap finance that used to be the preserve of rich countries. Some, like Botswana, have no dollar bonds at all, preferring to borrow in their own currency.

Throughout 2020, the 66 economies assessed will have to find over $4 trillion to service their foreign debt and cover any current-account deficits. Excluding China, the figure is $2.9 trillion. But this leaves out the buffers that emerging economies have accumulated. The governments in this exercise hold over $8 trillion in foreign-exchange reserves (or almost $5 trillion, excluding China). Half have enough reserves to cover all of their foreign-debt payments due this year and any current-account deficits. The rest (including 27 of the bottom 30) have a combined reserve shortfall of about $500bn. By far the largest gap in dollar terms is in Turkey, which has swiftly depleted its reserves by intervening to prop up the lira.

For the complete article: http://www.economist.com/briefing/2020/05/02/which-emerging-markets-are-in-most-financial-peril?