A whistleblower complaint to the U.S. Securities and Exchange Commission cites “egregious” violations by ReconAfrica and executives.

By Laurel Neme and Jeffrey Barbee

ReconAfrica, a Canadian company exploring for oil and gas upstream of one of Africa’s most lush and wildlife-rich habitats, may have fraudulently misled investors by misrepresenting its work on the project, according to several experts and allegations in a whistleblower complaint filed with the U.S. Securities and Exchange Commission (SEC).

The whistleblower, who acknowledged having submitted the report confidentially to avoid retribution and harassment, allowed National Geographic to review the 44-page confidential complaint filed on May 5. It alleges that, to drive up its stock price, ReconAfrica has violated securities laws by failing to disclose crucial information about its plans to look for oil and gas deposits across 13,200 square miles of sensitive wilderness in Namibia and Botswana, a region that includes part of the watershed of the world-famous Okavango Delta and six community-run wildlife reserves. The company’s value increased from $191 million at the start of the year to more than a billion dollars in mid-May. The complaint, which relies on public records, cites what it says are more than 150 instances of misleading statements by ReconAfrica, alleges that the company raised millions of dollars by fraudulent means, and claims that several top executives sold their shares while ReconAfrica promoted the stock. On May 19, the day after National Geographic sent questions to ReconAfrica, the company submitted 22 additional filings, including new disclosures and amended reports, with Canadian regulators.

ReconAfrica has licenses to look for oil and gas in the region, but since October it has faced increasing criticism for failing to implement standard environmental protections, operating without approved water permits, and ignoring local people’s concerns about the potential impacts the project could have on their homes and water supplies—and on the region’s wildlife as well, National Geographic has reported.

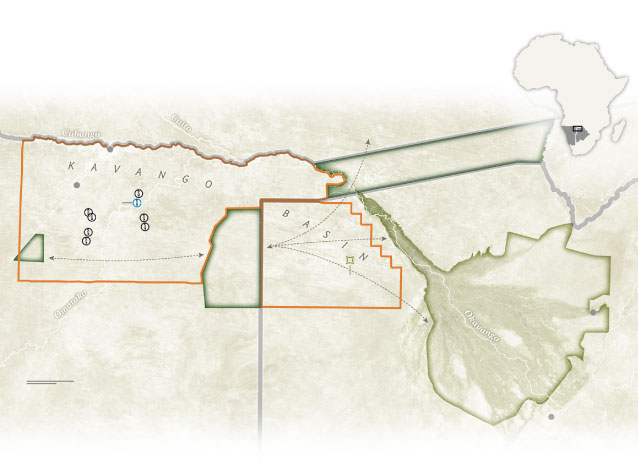

Licenses allow for oil and gas exploration in Namibia and Botswana.

ReconAfrica believes that a formation known as the Kavango Basin holds significant amounts of oil and gas. The company’s licensed region, which covers more than 13,200 square miles, is home to some 200,000 people and abundant wildlife and includes important migratory routes for the world’s largest remaining elephant population.

The area targeted by ReconAfrica supports the largest remaining herds of endangered elephants on Earth and other threatened and endangered species, such as cheetahs, rhinos, African wild dogs, vultures, and southern ground hornbills.

Every drop of water in the desert region is so crucial that Botswana’s currency is called pula, the Setswana word for “rain.” But oil and natural gas extraction is a thirsty industry, which is why communities and environmental activists are especially worried about ReconAfrica’s plans. Oil and gas drilling also is known to contaminate groundwater.

In its 2020 annual information form filed with Canadian regulators in April, ReconAfrica notes that, because ReconAfrica earns no revenue, its only source of funds is investors. This, combined with misleading promotional statements, would be of serious concern to regulators, the whistleblower says, because it’s putting other people’s money at risk. ReconAfrica’s activities “don’t just hurt investors, who may have bet their life savings or COVID relief check on the internet hype,” the whistleblower told National Geographic. They also have the potential to cause the “devastation of one of the last and most unique wilderness areas on Earth.”

‘A bold claim’

“Is This the Most Exciting Oil Play of the Decade?” reads the headline of a promotional article sponsored by ReconAfrica. Another sponsored piece calls the company’s southern African project an opportunity that “could be worth billions.”

To date, ReconAfrica has not done a seismic survey, National Geographic has reported, and it has completed only one test well of unknown depth in northeastern Namibia. Yet the company announced in a press release on April 15 that the well showed indications of oil and gas.

Outside experts believe that much more probing is needed to confirm an exploitable discovery and that ReconAfrica’s statements about the potential are premature and possibly misleading.

“This is a bold claim, and as such it requires bold data to back it up,” says Matt Totten, Jr., a petroleum geologist who did oil and gas exploration in Texas while working for BP and is not involved in the ReconAfrica project. To make such a claim, Totten says, a company would need more information from seismic analysis of the geology and multiple test wells.

The company has published reports on the region’s geologic structure, geochemical analysis, and an aeromagnetic survey. ReconAfrica “certainly didn’t provide any technical information… which could be evaluated independently or which could be used to value the resource. And yet we have a tripling of the share price,” says Stephen MacSearraigh, an oil industry expert who wrote a World Bank study on corruption in the petroleum sector.

“They are aggressively pumping the stock price, but if the resource they’re strongly hinting at isn’t actually there, or isn’t of the magnitude they’re suggesting, this is a house of cards.”

Until more data are made public, Totten says, “I think the public and local officials should remain cautious about the project.” ReconAfrica, which responded to some—but not all—of National Geographic’s questions by press time, says two third-party companies verified evidence of oil in the test well, and another did an “initial analysis” of the well’s data. But ReconAfrica did not provide the documentation.

Flip-flop on fracking

The complaint to the SEC also alleges that insiders at ReconAfrica and another Canadian corporation, Renaissance Oil, which has the same founder, are violating U.S. securities laws by promoting revenue projections to investors based on activities, such as fracking, for which it has not secured permission or permits. The complaint alleges that ReconAfrica is telling government officials and the public that it won’t use fracking, while its investor presentations and CEO have indicated that if the company found oil and gas, it planned to use fracking to extract at least some of it, as National Geographic reported in October. Fracking is a controversial practice in which underground shale is injected with high-pressure fluid to crack open rock to release oil and gas. It requires large amounts of water and has been known to cause earthquakes, pollute water, release greenhouse gases, and lead to birth defects in people and animals, among other problems.

After the company’s plans were widely reported in late 2020, Namibians and environmental activists reacted to the prospect of fracking with a mix of concern and outrage, and the company publicly backtracked. ReconAfrica began emphasising in statements that it would focus on oil and gas that could be recovered with conventional drilling methods, and it scrubbed its website of earlier allusions to fracking. On February 25, Botswana’s minister of mineral resources, green technology, and energy security, Lefoko Moagi, said the country would not allow fracking. On March 8, Maggy Shino, Namibia’s petroleum commissioner, noted that ReconAfrica had no license to frack, “and no such license is being contemplated.” This was not explained to investors, says the complaint.

“It is crucial that the process and operations are transparent and aboveboard.” – PATRICK LEAHYU.S. SENATOR FROM VERMONT

But even as ReconAfrica is saying that it won’t use fracking, it has continued to base its oil production and revenue estimates on the technique in its research reports, according to Erica Lyman, a law professor and director of the Global Law Alliance for Animals and the Environment at Lewis and Clark Law School, in Portland, Oregon.

“On one hand, the company has said that fracking is not in their vocabulary, and they’ve changed references throughout their website,” Lyman says.

“But on the other hand, their investor reports, the expertise of their staff, and their statements regarding the scale of the resources here all appear to be based on fracking of unconventional resources. It stands to reason that the public is confused.”

ReconAfrica says “there is no intention for any fracking activities.” The company told National Geographic that it has not applied for nor been granted a license to frack by Namibia or Botswana. As part of ReconAfrica’s submissions on May 19, the company filed an amended annual information form and amended statement of reserves with Canadian regulators, removing reference to “unconventional” resources in the former and clarifying challenges in recoverability in the latter document (“unconventional” refers to oil and gas that would need to be recovered by fracking).

Whether ReconAfrica will seek permission to drill and frack in Namibia, which would affect its potential earnings, “is vital information that a reasonable investor would want to know,” says Frederick M. Lehrer, a former SEC enforcement attorney who has more than 20 years’ experience in corporate finance and securities law, and is not involved in the whistleblower case. As such, the information “is legally required to be disclosed” to investors, he says.

ReconAfrica also appears to have misled investors by making statements in environmental reports and to media about its ability to procure oil while also following Namibia’s laws and permitting processes, the SEC complaint and Lehrer say. When ReconAfrica started drilling its first test well, in January, Namibia’s ministry had not approved the required water supply and disposal permits, according to Calle Schlettwein, Namibia’s minister of agriculture, water, and land reform. Schlettwein told National Geographic in March that the company had applied for water use permits that had not yet been approved; he also said his ministry had not received “any application for the permit to dispose of wastewater.”

The ministry did not respond by press time with an update on the permit applications’ status.

ReconAfrica says it’s not disposing of wastewater on site and that it has “worked closely” with Namibia’s government to “secure approvals and permits for the legal operation” of its wells. Meanwhile, community members in the exploration area allege that ReconAfrica has cleared land for drilling without properly consulting or compensating local people, according to a lawsuit filed in April on behalf of Andreas Sinonge, a farmer, by the Legal Assistance Centre in Namibia’s High Court. Under Namibian law, ReconAfrica needs rights to use the land before it can clear it for drilling sites and access roads. The lawsuit alleges that ReconAfrica did not get this permission and must restore Sinonge’s farmland. Since the lawsuit was filed, the company put out a public notice in the New Era newspaper on May 14 for an application to get land rights. ReconAfrica says its application is under review by the regional government and that it has “documented permission and consent for land use” from the local traditional authority, though it did not provide that documentation to National Geographic.

In the complaint to the SEC, the whistleblower says it’s vital for the project’s investors and potential investors to know whether the company is operating in violation of any Namibian laws.

“There’s a lot of hype, and a lot of questionable transactions, and that’s a set of circumstances regulators have a duty to investigate to make sure everybody’s playing straight,” MacSearraigh says.

ReconAfrica’s 2020 annual information form acknowledges that the company can’t promise it will be able to get all the necessary permits and approvals for its work, which contradicts its public statements. The form states that not getting the permits could have an “adverse effect” on its business and prospects. Among the issues highlighted in the complaint, it notes that company officers sold ReconAfrica stock while the company was putting out positive news and reports, according to Canada’s database of insider trading disclosures. But ReconAfrica did not alert potential investors about the activity, which, Lehrer says, is an omission of “vital information.” This lack of disclosure, he says, could be considered “stock scalping”—the practice of recommending that investors buy while insiders covertly sell their own stock.

“The big question for investors is why insiders were secretly selling their shares while promotional materials touted the company’s prospects,” he says.

ReconAfrica says all trades were part of the “normal conduct of business” by executives and have been disclosed as Canadian law requires. It did not comment on U.S. securities requirements, even though the company is traded in both countries.

Round-robin dealings

The complaint to the SEC also points out a round-robin-style deal that ultimately will cost ReconAfrica and its investors millions while allegedly enriching the company’s co-founder and largest identified shareholder, Craig Steinke. According to a press release, a series of transactions began in June 2020 when Steinke paid $74,600 for an option for a 50% stake in ReconAfrica’s Botswana prospecting license immediately after it was issued. He then sold that option to Renaissance Oil—of which he is the CEO—for $74,600 plus 30 million shares of stock, which the company said was valued at nearly a million dollars in some documents and over $2.1 million in others, according to Renaissance Oil’s SEC filings and a press release. Then last month, ReconAfrica announced it intended to buy Renaissance Oil in large part to get its full stake back, in a deal it said was worth roughly $128 million.

In a press release, ReconAfrica’s CEO, Scot Evans, cited the reacquisition of the entire Botswana license as “potentially very valuable to ReconAfrica.” Essentially, ReconAfrica sold the option cheaply and then spent a lot of money to buy it back—a bad deal for ReconAfrica stockholders but a good deal for Steinke and Renaissance Oil, the complaint says. Renaissance Oil was struggling financially when the sale was announced, and given its cash position at the end of last year, the Botswana license appeared to be one of its main assets, according to the SEC complaint. In the days before the public announcement, Renaissance Oil’s stock value more than tripled. (This also may have benefited its production partner on a project in Mexico, the Russian company Lukoil, which is under sanctions by the U.S. government.)

ReconAfrica, Renaissance Oil, and Steinke did not answer questions about these transactions.

According to Lehrer, each company disclosed only part of the deal to U.S. regulators. For example, Renaissance Oil did not disclose the fact that it knew it paid far more for the stake in Botswana than ReconAfrica had sold it for. Renaissance Oil would have known that because it has the same CFO and corporate secretary as ReconAfrica. Furthermore, when ReconAfrica recently announced its plans to acquire Renaissance Oil, explicitly for its option in the Botswana license, it failed to tell investors that it had sold that stake for only $74,000, the previous year, according to the complaint. This lack of disclosure possibly violates U.S. securities laws, according to Lehrer, because it could affect whether someone decides to invest in the company.

Calls for “a thorough investigation”

All this suggests, the whistleblower alleges, that ReconAfrica, Renaissance Oil, and their personnel aim to “enrich themselves while hurting the environment, animals and people in this region.”

Given the scarcity of water in the Okavango region, MacSearraigh says, “it would seem prudent for the governments concerned to order a halt to all drilling activity while a thorough investigation is conducted by regulators.”

Concerns about ReconAfrica’s activities are growing. U.S. Senator Patrick Leahy, a Democrat from Vermont who has long been active on human rights and environmental issues, says the U.S. government has an interest in monitoring ReconAfrica’s project. That’s because the DELTA Act, enacted by the U.S. Congress in 2018, promotes the wise management of the Okavango watershed.

“Oil and gas drilling poses a grave threat to the Okavango, and the company has ignored or belittled the serious concerns of local communities,” Leahy says.

“It is crucial that the process and operations are transparent and aboveboard. If oil is discovered, the harmful consequences for the environment, wildlife, and local people could be irreversible.”

Meghan Miner Murray contributed to this series.

Wildlife Watch is an investigative reporting project between the National Geographic Society and National Geographic Partners focusing on wildlife crime and exploitation.

This article was published on MAY 21, 2021 on nationalgeographic.com